Maritime Services Introduction:

Ebury has a broad range of financial services. Could you explain how maritime services fit into

Ebury’s overall offerings and what specific services you provide to maritime clients?

This is another great question and is also what spurred Ebury into creating a dedicated business unit.

The maritime industry is unique and thus has a fairly unique set of requirements, which many

traditional banks and other financial service providers have struggled to support due to a lack of

general industry understanding. Additionally, much of the industry is perceived as high risk, meaning

there are even fewer providers willing to support, let alone offer value-added services to their clients.

Those that can often increase their pricing to manage this “perceived risk,” leaving the industry

somewhat underserved, or at the very least, overpriced.

Almost all of Ebury’s core services are a natural fit for the industry, as we are able to facilitate

international trade by removing potential barriers, or should I say borders, which is as per our

branding, “Ebury - What Borders?”. In terms of the specific services we offer, we have three key areas:

Cash Management :

Ebury has built an impressive infrastructure, combining the might of over twenty tier-1 banking partners which we offer to our clients. This includes named currency accounts in multiple jurisdictions, allowing for the local collection of funds and eliminating

a significant proportion for both parties in the transaction. This also provides our clients with access

to significant payment capabilities, allowing them to send funds in over 130 currencies to over 160 countries, almost 40 of which can be sent as local transfers.

Treasury Solutions :

At the core of our business is our FX risk management solution. As one of Bloomberg’s top-rated forecasters globally, and being able to offer everything from spot trading to forward contracts, Ebury is incredibly well positioned to support maritime clients globally. We also have a strong emerging markets proposition, with access to many emerging market currencies, which help reduce our clients’ costs significantly.

Supplier Payment Financing :

Ebury has seen significant growth in this area, mainly driven by client demand. To date, we have provided in unsecured lending, covering almost 30,000 invoices and supporting thousands of Ebury clients with an easier, simpler, and more cost-effective way of accessing the working capital they need to grow their businesses. By understanding and addressing the unique financial needs of the maritime industry, Ebury ensures that our clients receive the tailored support they require to thrive in a challenging environment.

Maritime Financial Challenges:

What are some of the unique financial challenges faced by the maritime industry today, and how does Ebury help address these?

As already mentioned, the maritime industry is unique and therefore has a distinctive set of financial challenges. Aside from the aforementioned compliance hurdles that many of our clients faced before joining Ebury, there are also challenges caused by a general lack of industry understanding, which creates further confusion.

To add to this, almost all maritime payments are considered urgent, whether it’s a payment to a port agent or a salary payment to a crew member. Therefore, being able to process time-sensitive payments on time, every time, is a significant strength of Ebury’s and a distinct advantage to our clients. Ebury specialises in facilitating international trade, so if you are a client with restricted cash flow and want to benefit from our supplier payment financing, or you have a global customer base and want to be able to issue invoices locally, Ebury is able to support. From the feedback we’ve had from our clients, the main value that Ebury delivers to its maritime clients is its comprehensive range of services provided by a team of experts, not just specifically one

or two parts of our collective offering.

Technological Advancements:

How is technology transforming financial services within the maritime sector, and what innovations has Ebury implemented?

The maritime industry is unique, with some companies being at the forefront of digital innovation and others still preferring to use “pen and paper.” This is also one of Ebury’s strengths, being able to support companies of all types, whether they are already on their digital transformation journey and therefore utilise our API capabilities to support with process automation, or whether they prefer a more traditional approach and choose to transact through our platform, on email, or over the phone.

From a client perspective, Ebury has invested in making constant enhancements to our client-facing products, ensuring maximum uptime, minimal disruption, and easy connectivity with systems like Oracle Netsuite and Xero. We’ve also developed our own mobile application for our UK clients, which allows them to access their accounts and transact “on the go.”

Global Operations:

Ebury operates in multiple countries. How do you tailor your maritime financial services to meet the diverse needs of international clients?Being a truly global provider is just part of the value we bring to our clients. Ebury operates across 29+ markets and 40+ offices, meaning we can manage most local requirements too.

For some of our clients, the value could be as simple as having their own dedicated account manager who can communicate in their own language, whereas for others, the value could be in our extended trading hours, which allow clients to trade 24 hours a day, five days a week. For international clients with multiple offices across the globe, Ebury can provide holistic services from

one centralised platform, ensuring standard processes, local independence, and global visibility for all teams involved.

Risk Management:

How does Ebury manage risk in its maritime financial services, and what measures are in place to protect your clients?

It is worth noting that Ebury Partners UK Ltd is not a bank, but an Electronic Money Institution. As such, and in respect of safeguarding client funds, Ebury uses segregated client accounts in accordance with Electronic Money Regulations, which is a safe way to hold balances. Ebury maintains all client funds in segregated, ring-fenced accounts with tier 1 banks,

separate from our operating accounts, and regulated in six markets. This means that our clients’ funds are safeguarded appropriately.

In terms of compliance, and as already mentioned above, Ebury is regulated across six markets, including the Financial Conduct

Authority (FCA) in the UK and the National Bank of Belgium (NBB) in Belgium. Our approach to compliance is very much

proactive, meaning we aim at eliminating potential issues before they occur. When coupled with our extensive maritime experience, our approach to compliance ensures our clients can operate with certainty and security. Compliance is one of the cornerstones of our organisation and as such, is embedded across all of our products and services, ensuring that

both our clients and Ebury are protected.

Client Success Stories:

Could you share a success story where Ebury’s maritime services

significantly benefited a client?

We recently onboarded a UK client that has two further offices in Europe, as well as a joint venture

with a company in Hong Kong.

Our client had seen significant growth in a short space of time, which meant that they had different

processes and different banking relationships in each country they operated. This also meant multiple

logins to their respective bank systems.

Through Ebury, our client was able to move to a single system to manage all of their global funds,

while implementing a standard process across all regions and ensuring full integration with their

accounting system. In addition, they were also able to access Ebury’s global infrastructure, allowing

them to open named, local currency accounts in each of the jurisdictions they operate in, which

helped to significantly reduce their international costs. More specifically, they were able to

open named currency accounts in the locations of their biggest customers, which meant they could

now issue local invoices for local settlement, thereby reducing the fees involved for all parties and

speeding up the settlement time to access their funds.

Finally, we were also able to support our client with a comprehensive risk management strategy for

their FX exposure, enabling them to budget their international sales and revenue at a secured rate,

ensuring they were able to publish their prices for the entire financial year.

Future Trends:

What future trends do you foresee in maritime finance, and how is Ebury preparing to meet

these evolving demands?

Having our “finger on the pulse” is paramount to the success of our organisation, so many of the

developments we have made and will continue to make are driven by client insight and demand. We

see our clients as partners and therefore nurture those relationships to become mutually beneficial,

using our clients to sound out our ideas that we believe will benefit the industry, as well as hearing our

clients’ suggestions as to how they believe we might be able to help solve their existing challenges.

One of the biggest trends we currently see is digitalisation, which is working its way across almost

every corner of the maritime industry. Almost all companies will have different priorities, especially

following recent world events and the newly introduced emission caps, but many of our clients have

started their digitalisation journey internally by reviewing the manual, labour-intensive, and paper-

driven processes throughout their organisation. By introducing technology that supports more

optimal processes, companies can achieve significant benefits that help to increase visibility, reduce

the risk of mistakes through manual intervention, free up the time of the teams involved, and more

often than not, reduce costs.

Integration with third-party systems is therefore crucial for Ebury and for us to be able to play our

part in supporting our clients’ digitalisation journeys. To this end, Ebury has invested heavily in API

capabilities, meaning we are able to offer full two-way communication with our clients’ ERP software,

crewing platforms, vessel management systems, and treasury management systems, allowing for

seamless automation and reconciliation.

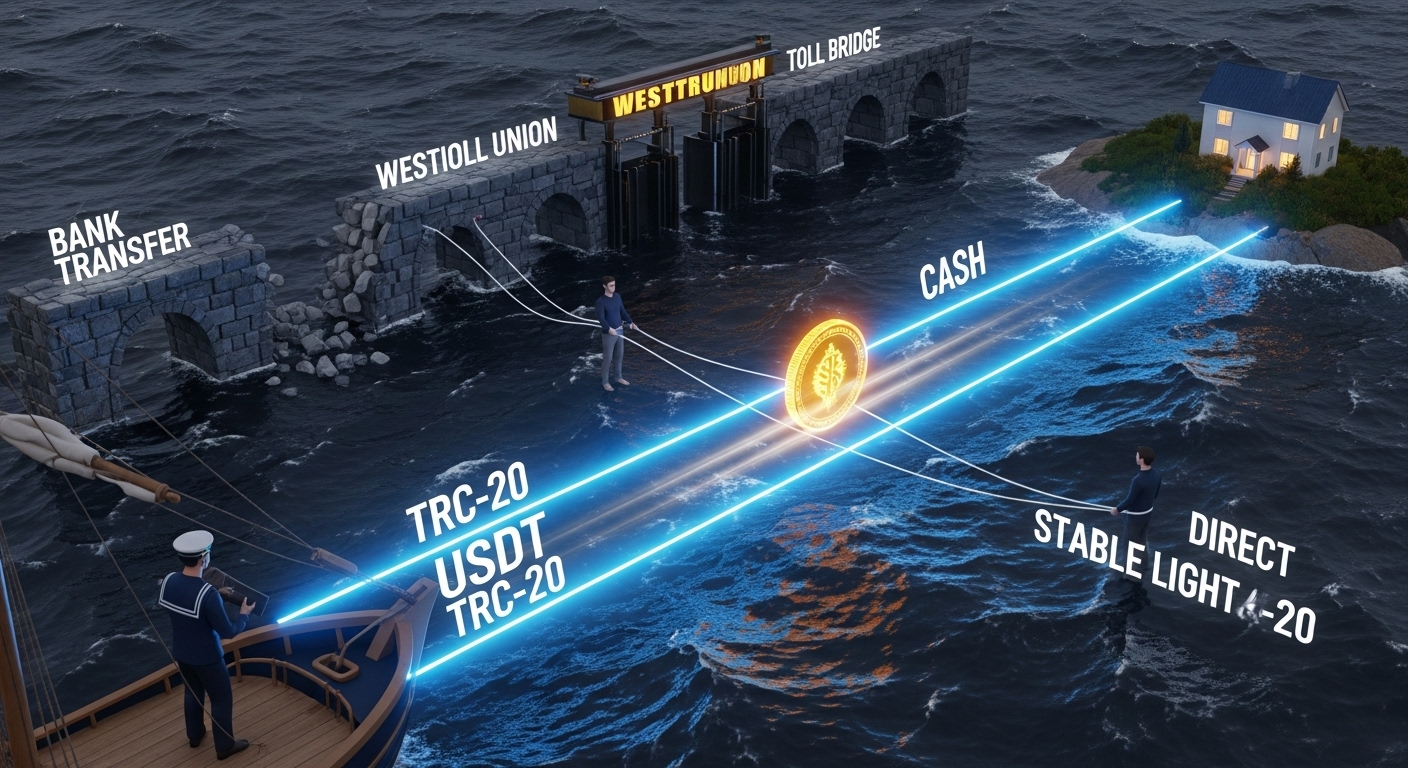

Another big trend we have seen is the push to reduce or even eliminate the reliance on cash within

the industry. Cash is still widely used onboard vessels to pay disembarking crew any balance of their

wages (which can be complicated for the company to settle from shore), to pay port and other local

expenses where digital payment facilities may not be present, as well as for other eventualities that

are sometimes difficult to predict. While this generally makes life more convenient for the crew of the

ship, it also carries several inherent risks and costs, as well as exposing both the shipping company

and their crew unnecessarily. With the introduction of digital payment solutions, the maritime

industry can now free itself from its reliance on cash, which helps free up cash flow, reduce the costs

associated with delivering, as well as reduce all of the aforementioned risks.

Closing Statement:

Ebury’s Commitment to the Future of Maritime Finance

With Ebury’s significant global presence and capabilities, our deep experience in supporting

the global maritime industry, our constant innovation in technology, and through the incredible

partnerships with fellow market leaders, Ebury is privileged to be able to support our clients in their

digital finance transformation journeys.